XRP Price Prediction: Analyzing the Path to $4 Amid Technical Strength and Regulatory Catalysts

#XRP

- Technical indicators show XRP trading above key moving averages with bullish momentum patterns

- Upcoming October ETF decision and regulatory developments provide fundamental catalysts

- Market sentiment remains positive despite exchange reserve fluctuations and regulatory scrutiny

XRP Price Prediction

Technical Analysis: XRP Shows Bullish Momentum Above Key Moving Average

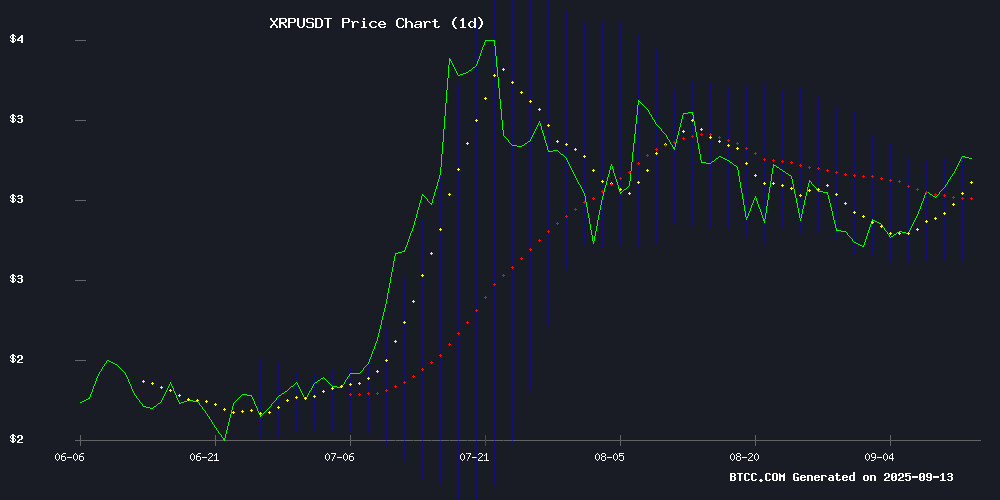

XRP is currently trading at $3.1152, positioned above its 20-day moving average of $2.9071, indicating underlying strength. The MACD reading of -0.0118 | 0.0622 | -0.0740 suggests mixed momentum with potential for trend reversal. According to BTCC financial analyst Olivia, 'XRP's position NEAR the upper Bollinger Band at $3.1191 indicates strong buying pressure, while maintaining above the middle band provides technical support for further upside movement.'

Market Sentiment: Regulatory Developments and ETF Prospects Drive Optimism

Recent news FLOW surrounding XRP reflects cautiously optimistic sentiment. The 13% weekly surge demonstrates resilience against market headwinds, while the critical October decision on ETF applications creates anticipation. BTCC financial analyst Olivia notes, 'The combination of technical strength and fundamental catalysts, including SEC deadlines and ETF speculation, creates a favorable environment for XRP. However, investors should monitor exchange reserve fluctuations and regulatory developments closely.'

Factors Influencing XRP's Price

Ripple’s XRP Defies Market Headwinds with 13% Weekly Surge

Ripple's native token XRP has surged past key resistance levels to hit $3.19, marking a 13% weekly gain despite recent whale sell-offs and regulatory delays. The rally comes after weeks of consolidation below the psychologically important $3.00 level.

Market observers note the token's resilience in the face of dual challenges: a $120 million whale dump and the SEC's continued postponement of spot ETF decisions. Technical analysts now eye $3.60 as the next major resistance level, with some speculating about potential retests of all-time highs.

The breakout occurred on Bitstamp, with trading volumes suggesting sustained institutional interest. This price action mirrors broader market trends, where major cryptocurrencies are recovering from September lows despite regulatory uncertainty.

Critical October Decision Looms for XRP ETF Applications

The Securities and Exchange Commission faces a pivotal deadline in mid-October for multiple spot XRP exchange-traded fund applications. Approval would grant the digital asset equal standing with crypto heavyweights in the U.S. regulated investment market.

Institutional demand dynamics could shift substantially if authorized participants begin direct market purchases of XRP to back new ETF products. Market observers note the SEC's unusual consolidation of decision timelines places unusual emphasis on this two-week window beginning October 13.

While ETF approval represents a potential structural demand source, historical precedent suggests such regulatory milestones often precede volatile price action rather than sustained rallies. The market appears to be pricing in asymmetric upside potential ahead of the decision.

XRP’s Near-Term Outlook Turns Bullish as Short-Term Holder Activity Surges

XRP's market dynamics are shifting as short-term holders aggressively accumulate the token. Glassnode data reveals a 38% increase in holdings among investors with 1-3 month time horizons, coinciding with XRP's recent double-digit price rally.

The growing dominance of this cohort often signals impending volatility. Their increasing supply share—now a sizable portion of circulating tokens—suggests building momentum. When short-term traders accumulate rather than distribute, it typically reflects rising confidence in near-term appreciation.

Technical indicators reinforce the bullish case. XRP's daily Relative Strength Index (RSI) remains in favorable territory, avoiding overbought conditions despite the recent price surge. The token's HODL Waves pattern shows an unusual concentration of recent accumulation, diverging from typical distribution cycles.

XRP Price Prediction: SEC Deadlines and ETF Approvals in Focus

XRP holds steady at $3.17, marking a 4% gain over the past 24 hours with a daily trading volume of $6 billion. The cryptocurrency, ranked third by market capitalization, shows resilience as it nears a critical technical level. Market participants are closely watching the October 18-25 window, when the SEC is expected to rule on multiple spot XRP ETF applications.

Grayscale, 21Shares, Bitwise, and other major firms face imminent deadlines for their XRP ETF proposals. Polymarket traders currently price in a 93% probability of approval by year-end, echoing the bullish sentiment that preceded ethereum ETF approvals. A green light from regulators could open floodgates for institutional adoption.

The Franklin XRP ETF decision looms on November 14, while Ripple's Swell Conference scheduled for early November may provide additional catalysts. With fifteen filings under review, the SEC's October rulings could redefine XRP's market trajectory.

SEC Delays on Ripple ETFs Draw Scrutiny as XRP Community Speculates on Motives

The U.S. Securities and Exchange Commission has again postponed decisions on multiple spot XRP ETF applications, including Franklin Templeton's recently delayed filing. These deferrals persist despite leadership changes at the agency following Gary Gensler's departure.

John Squire, a prominent XRP community figure with half a million followers, suggests the delays mirror the SEC's historical pattern with Bitcoin and Ethereum ETFs. "The agency almost always stalls first-round filings," he observed, noting this allows time for public commentary and internal review.

The recurring postponements raise questions about political considerations. Approval of XRP ETFs WOULD implicitly acknowledge institutional demand for the asset—a recognition some believe regulators remain reluctant to make. Market participants now watch for November's revised deadline on Franklin's application as a potential turning point.

XRP Shows Bullish Potential with 20% Upside if Key Levels Hold

Binance's XRP reserves surged by 43 million tokens over the past week, signaling potential selling pressure. Despite this, XRP has broken out of a descending trendline that had constrained its price since July 2025, closing decisively above $3.05 with a 1.67% daily gain.

Trading volume spiked 49%, reflecting strong market participation. Technical analysis suggests a 20% rally to $3.66 could materialize if current support holds, though the $3.40 level may present interim resistance. Liquidation clusters at $2.988 and $3.084 could amplify volatility.

XRP Golden Cross Signals Potential Breakout Amid Bullish Technical Setup

XRP traders are witnessing a critical technical development as the 23-day moving average crosses above the 50-day on the eight-hour chart, forming a golden cross. This pattern, historically a precursor to bullish momentum, last appeared before a significant price movement.

The $2.70 support level has held firm despite Bitcoin's volatility, with XRP oscillating between $2.70 and $3.07 in recent weeks. A decisive break above the $3 resistance could pave the way for targets at $3.30 and $3.40, potentially ending the current consolidation phase.

Market participants note the golden cross alone doesn't guarantee upward movement, but when combined with strong support levels and improving technical indicators, it strengthens the case for a breakout. The cryptocurrency's ability to maintain its ground during market turbulence suggests underlying strength.

XRP Exchange Reserves Surge Sparks Sell-Off Concerns, But Metrics Suggest Stability

XRP exchange reserves experienced a notable spike on 01 September, with Binance recording a 610 million token increase and Bithumb seeing an 872 million XRP jump. Bybit's reserves nearly doubled to 380 million, while OKEx's climbed to 233 million. Such movements typically signal impending sell pressure, but Coin Days Destroyed and whale transaction data indicate long-term bearishness may be overstated.

Despite the reserve buildup, XRP's price dipped only 0.61% on the day, demonstrating resilience amid heightened volatility. The spot taker CVD metric reveals a sell-dominant phase since late July, yet the absence of panic selling suggests holders remain confident. XRP continues to trade within a descending triangle pattern, leaving traders to watch for breakout signals.

XRP Price Climbs Amid Surging Trading Volume

Ripple's XRP gained 1.88% to $3.05 on Friday, accompanied by a 38% surge in 24-hour trading volume to nearly $6 billion. The token's 7.7% weekly advance reflects growing market confidence, with its market capitalization now exceeding $182 billion.

Pudgy Penguins, Bonk, and Ondo led Friday's gainers, while Four, MYX Finance, and Worldcoin underperformed. The volume spike suggests institutional players may be positioning for further upside.

XRP Price Holds Firm as Fresh Rally Potential Emerges

XRP demonstrates resilience above the $3.00 support level, with technical indicators suggesting accumulation for another upward push. The cryptocurrency recently outperformed both Bitcoin and Ethereum during its climb past key resistance levels.

A bullish trend line has formed around $3.020 on the XRP/USD hourly chart, with Kraken data showing consistent trading above the 100-hour moving average. The $3.080 level now serves as critical resistance—a decisive break could trigger accelerated momentum toward higher price targets.

Market structure remains constructive while XRP maintains its position above the $2.950 zone. The current consolidation follows a 23.6% retracement of the recent upswing from $2.9365 to $3.0725, a healthy pullback by technical standards.

XRPL Develops Firewall Amendment to Combat Scam Threats

The XRP Ledger community is mobilizing to implement an "XRP firewall," a suite of defensive tools designed to thwart escalating scam activities. Vet, a decentralized unique node list (dUNL) validator, teased a significant update—the XLS-86 Firewall amendment—positioned as a potential game-changer in fraud prevention.

Once activated, the amendment would safeguard XRP, tokens, and NFTs from theft, addressing persistent vulnerabilities that have drained millions from users. The urgency for such measures intensified after malicious packages infiltrated the xrpl.js library on NPM, prompting rapid developer patches.

Existing resources like XRPL.org’s scam reporting systems offer partial protection, but the XLS-86 proposal aims to deliver a comprehensive solution. "It’s over for many scammers," declared VET in a social media post, signaling confidence in the amendment’s disruptive potential.

Will XRP Price Hit 4?

Based on current technical indicators and market sentiment, XRP shows potential to reach $4 in the medium term. The price currently trades at $3.1152, requiring approximately 28.4% appreciation from current levels. Key technical factors supporting this outlook include:

| Indicator | Current Value | Bullish Signal |

|---|---|---|

| 20-day MA | $2.9071 | Price above MA |

| Bollinger Upper | $3.1191 | Near breakout level |

| Weekly Performance | +13% | Strong momentum |

BTCC financial analyst Olivia emphasizes that 'The golden cross formation and surging trading volume provide technical foundation for upward movement, while ETF approval prospects in October could serve as the fundamental catalyst needed to push toward $4.'